Monetary Prosperity

Economic transactions beyond borders, banks, and bureaucracies

(only producers create money)

Removing the constraints of currencies so that everyone can prosper

On the one hand we have skills, and on the other, needs. Without money skills are unemployed, and needs, unmet.

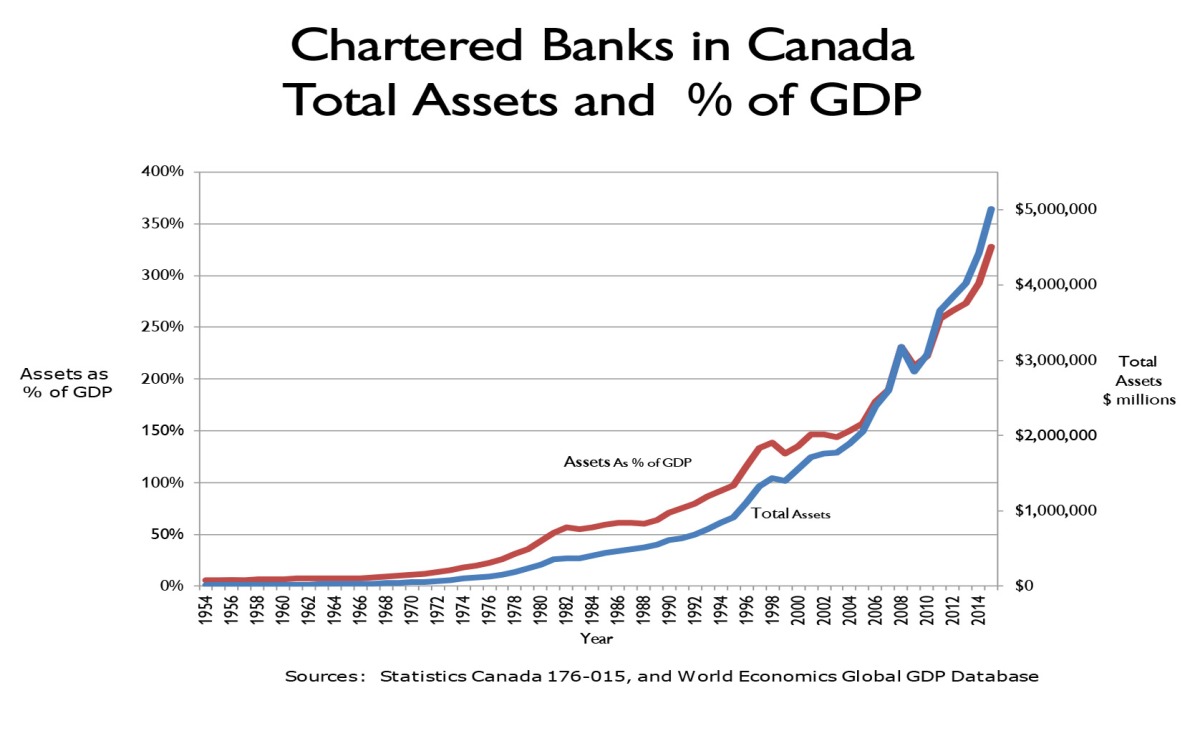

Money does not come from vaults, but is created with bookkeeping by private corporations called banks. Even governments go to banks for money.

Bank money is issued as debt (claims on your assets) at compounding interest causing recessions, unemployment, and bankruptcies through no fault of the user.

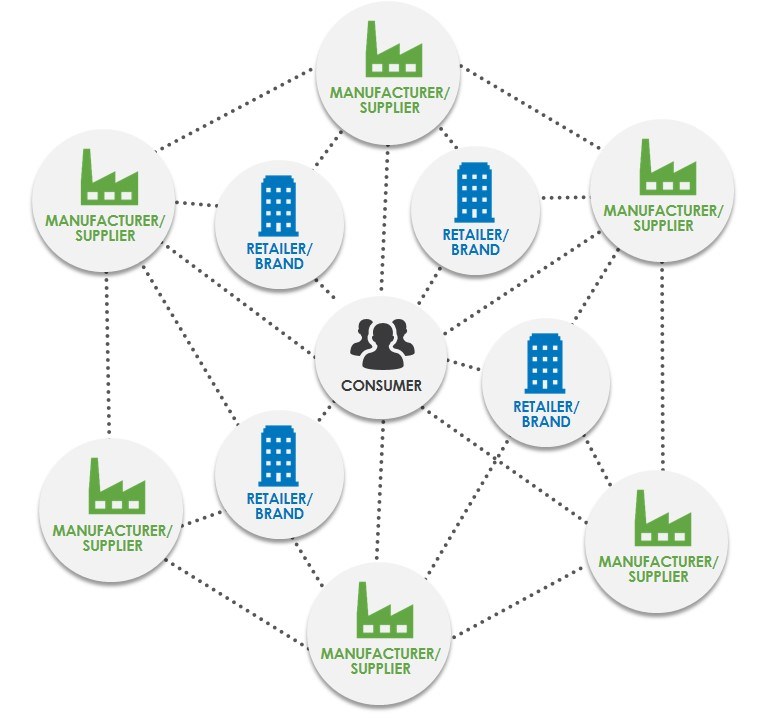

Mutual Credit is simply accounting for work (employing skills and meeting needs) without debt or interest.

Derivatives and currencies far exceed GDP and trade, threatening a system that has to keep “printing”. We need alternatives to transact and survive.

Mutual Credit

The issue is about how money is created, whether: 1. As debt at compounding interest, or 2. As credit without interest payments draining the money supply

Commercial currency

Could we consider a “commercial currency”, alongside government currency (notes and coins), bank currency, and perhaps gold and bitcoin?

We propose another current asset type to accommodate settlement of payables/receivables without the need for a line of credit. Let’s call this account “commercial currency”, alongside bank, petty cash, receivables, inventory, and other current assets.

…

Funding UBI

We distinguish between the currently popularised UBI financed by tax and debt, and a citizens’ dividend which distributes wealth created by citizens.

In contrast to welfare, the dividend does not discourage work, but rather enables initiative, entrepreneurship, and career choices.

We show the monetary accounting so that citizens receive a dividend at the rate of…

Where does money come from

One the one hand we have skills and resources, and on the other there are needs, wants, and desires. Somehow needs cannot be satisfied with available skills and resources without some magical medium called money.

The most common sources of money are mining, debt, and credit.