The essence of the problem is where does money come from, and who benefits from its creation, the people or the banks?

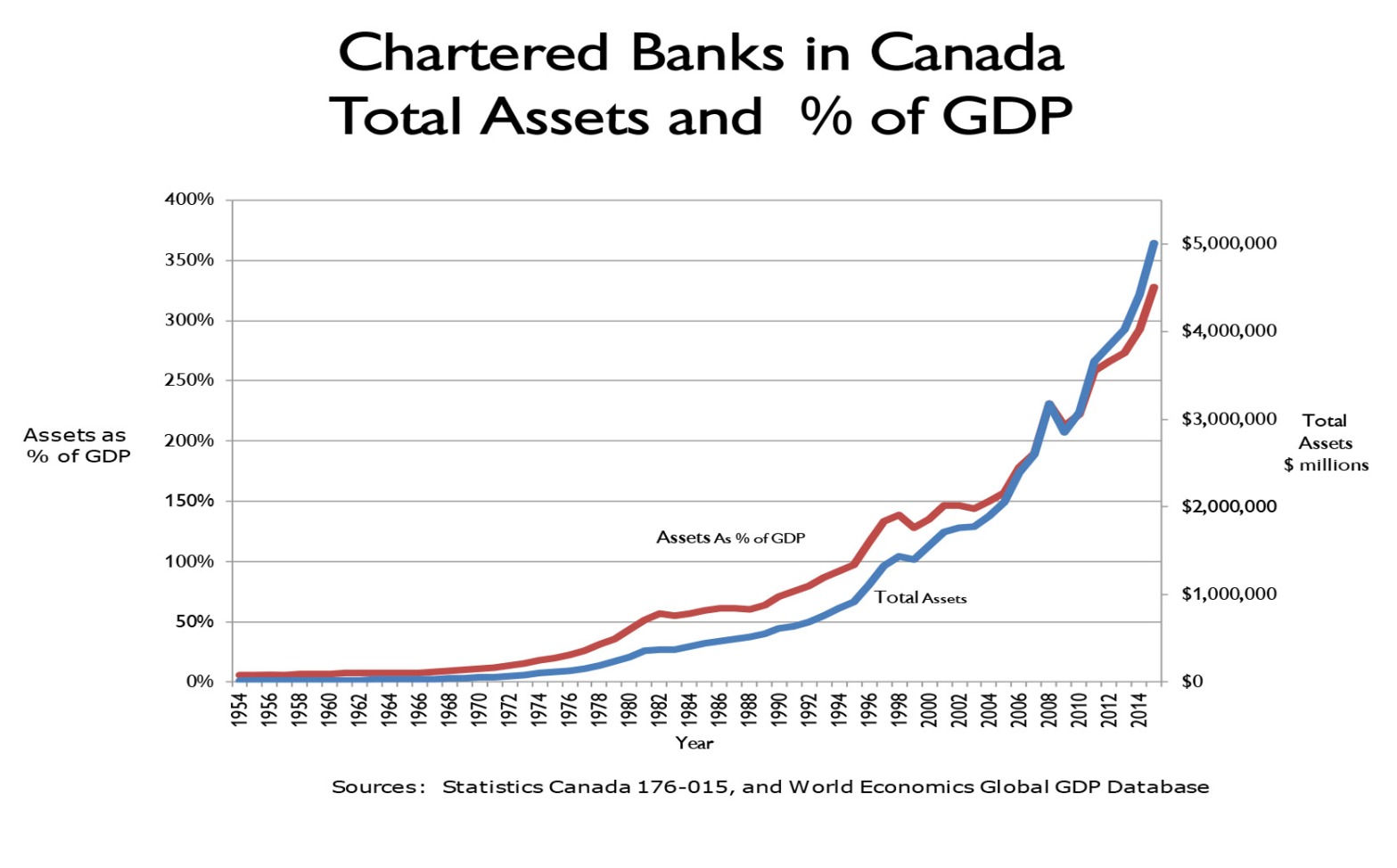

It is probably redundant to point out the severely skewed outcomes of the current monetary system such as stagnant real wages despite productivity growth, the exponential difference in wealth, and the parabolic accumulation of wealth by banks.

We discuss how bank loans are created, and how banks do bookkeeping.

We distinguish between the currently popularised UBI financed by tax and debt, and a citizens’ dividend which distributes wealth created by citizens.

In contrast to welfare, the dividend does not discourage work, but rather enables initiative, entrepreneurship, and career preferences.

We prove that there have been enormous seizures of wealth by banks through nothing more than sleight of bookkeeping.

What we propose that the bookkeeping leading to this misappropriation be corrected, and that citizens receive a dividend at the rate of growth of the economy to maintain price stability, or to stimulate growth.

Please click here for the report

= = = = = = = = =